If you use AfterPay or Chime, you’ve probably wondered – can I use my Chime card with AfterPay? Well, you’re in luck!

Contents

The Short Answer

Yes – AfterPay does accept Chime cards for payments. As of 2022, users have reported no issues using their Chime debit cards with AfterPay’s “buy now, pay later” services.

Below we’ll walk through everything you need to know about linking your Chime account to make payments through AfterPay.

What is AfterPay and Chime?

For those unfamiliar:

- AfterPay is a “Buy Now, Pay Later” (BNPL) service that lets you split payments for online purchases into 4 interest-free installments.

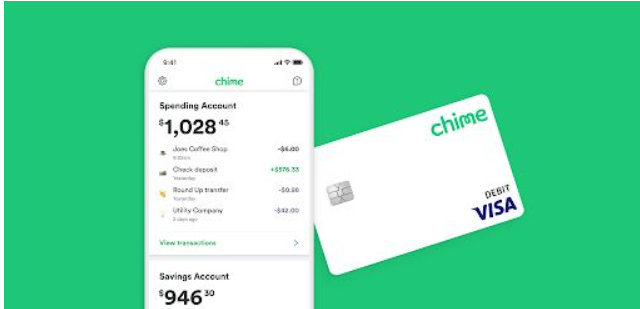

- Chime is an online banking app that provides fee-free debit cards and bank accounts. Many users sign up with Chime as their primary spending account.

So TLDR: AfterPay = online installment payments. Chime = online bank account.

Both are popular digital financial services aimed at millennials and Gen Z users.

Linking Chime and AfterPay

Connecting your Chime debit card to make payments on AfterPay only takes a few quick steps:

- Login to your AfterPay account

- Under Billing, select Payment Methods

- Enter your Chime debit card details (card number, expiration date, CVV code)

- Verify your identity if prompted

- You’re all set!

Once linked, you can use your Chime debit balance and direct deposits to pay for AfterPay purchases.

Tip: If you already have a payment method saved, select Change Payment Method instead to update your card details.

And there you have it! A simple process to enable Chime payments within AfterPay’s flexible BNPL checkout system.

Alternative “Buy Now, Pay Later” Services

If you encounter any issues using Chime with AfterPay down the line, there are a few similar services that accept Chime as well:

- Affirm

- Quadpay

- Sezzle

The availability of Klarna is still a bit unclear, but may open to Chime users soon.

Common Questions about AfterPay and Chime

Here are answers to some frequently asked questions:

Does AfterPay accept prepaid or gift cards?

No, AfterPay only directly works with major debit/credit cards from established banks. This excludes prepaid accounts.

What types of credit cards does AfterPay accept?

All major issuers are supported except Capital One, which blocks AfterPay transactions across their credit cards.

Can I pay through a Cash App card?

Not at this time, but AfterPay is exploring options to integrate Cash App payouts for merchants using their platform.

Is Chime considered a prepaid account?

No. Chime functions as an online bank account provider connected to legitimate financial institutions. So it’s supported like any other debit card payment.

Let’s Recap…

The bottom line – yes, Chime debit cards are successfully accepted as a payment method by AfterPay for installment plans.

You can easily link your Chime banking account to pay off AfterPay balances over time through their website.

We hope this guide gives you confidence using these two convenient finance tools together! Let us know in the comments if you have any other questions.