So you just got approved for an OpenSky credit card? Congrats! 🎉 Let’s walk through how to activate it so you can start using this tool to build your credit.

Contents

Why OpenSky?

The OpenSky Secured Visa Credit Card is a great option if you’re looking to establish or rebuild your credit.

- No credit check needed to apply

- Get a credit limit matching your security deposit

- Could help improve your credit score over time!

It’s specifically designed for people with poor or limited credit history.

Activating Your Card at openskycc.com/activate

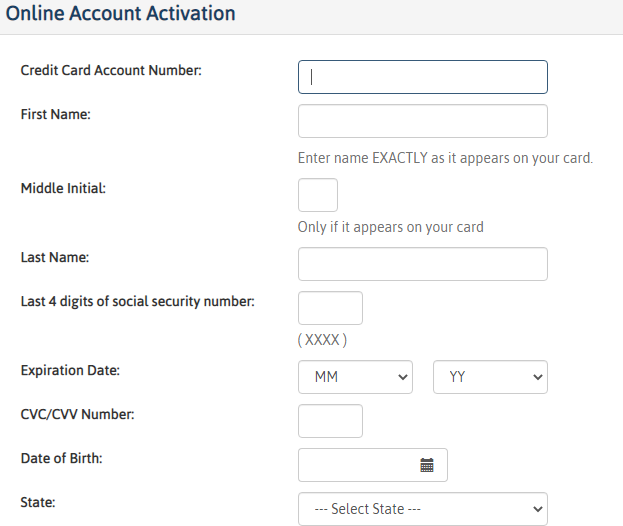

After your shiny new OpenSky card arrives in the mail, you’ll need to activate it before using it.

Here’s what to do:

-

Visit the activation site: openskycc.com/activate

-

Enter this information:

- Credit Card Number

- First and Last Name

- Last 4 of SSN

- Card Expiration Date

- CVV security code from back of card

- Date of Birth

- ZIP Code

-

Click “Submit”

Once submitted with correct details, it should activate instantly!

You can then register for online account access to manage your card and track your credit building progress.

Application Status Check

Can’t wait for the card and curious on status after applying? Follow these steps to check:

- Go to: Application Status Check

- Enter email, security word, last 4 SSN digits, and DOB

- Click “Check My Application Status”

This lets you see if was approved and when to expect delivery.

How to Apply for OpenSky

Want to get started with OpenSky yourself? Here is what you need:

✅ SSN or ITIN number

✅ 18+ years old

✅ Valid mailing address

✅ Debit card for security deposit

Then just visit their application page and provide:

- Personal details

- Address

- Income info

- SSN and DOB

- Security word

Next, accept terms and pick deposit amount between $200-3000. This equals your credit limit.

Submit payment details and application!

Start Building Credit

Now that you’ve activated your card, it’s time to start using this tool responsibly to build your credit history.

Some tips:

- Use lightly and make all monthly payments

- Keep utilization under 30%

- Check statements for progress

- Consider adding an authorized user later on

With smart practices, this card can help improve your score over time. 🙌

Let me know if any other questions come up!