So you’re looking to get some financing for your small business? Well you’ve come to the right place! Fora Financial offers short-term loans specifically designed to help entrepreneurs like you grow.

In this beginner’s guide, we’ll walk through everything you need to know about qualifying for and activating a Fora Financial small business loan. I’ll try to keep it simple and easy to follow. Ready? Let’s do this!

Contents

What is Fora Financial?

Fora Financial is an online lender that provides funding to small businesses in as little as 72 hours. Here are some key things you should know:

- Specializes in short-term, fast funding loans from $5,000 up to $500,000

- Quick and easy online application with instant decisions

- Funds provided in as little as 72 hours after approval

- No early payment fees and competitive rates

They really aim to make financing easy and accessible for businesses who need working capital, want to hire help, upgrade technology, market products, etc.

Check If You Prequalify in Minutes

Ready to check if your business meets the qualifications? It only takes a minute to get an initial decision.

You can start the easy prequalification process at forafinancial.com/applynow.

You’ll need to provide some basic personal and business details:

- First and last name

- Business name

- Email address

- Phone number

- Annual revenue

Pro Tip: If you received an activation code in the mail, enter it too for special offers!

Once submitted, you’ll quickly know if you prequalify and can move to the next steps. Super simple!

Key Loan Qualifications

Wondering what criteria you’ll need to meet? Here are the key requirements:

- Time in business: At least 6 months

- Annual revenue: Minimum $120,000

- Monthly credit card sales: Minimum $5,000

If your business meets these qualifications, there’s a good chance you’ll get approved!

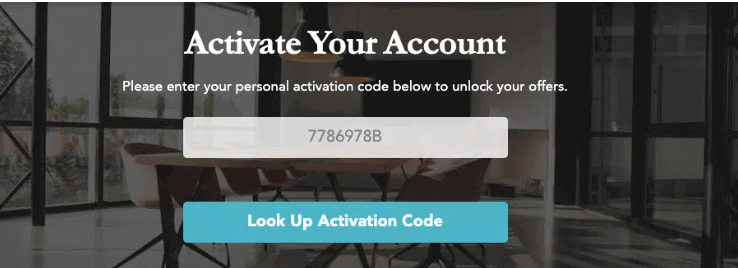

Activate Your Account

Got an approval? Congrats! Now you just need to activate your account to finish setting up your loan access.

Here are the quick steps:

- Visit forafinancial.com/activate

- Enter the 8-digit activation code from your approval letter

- Click “Look Up Activation Code” and follow the prompts

After activation, you’re ready to get funding in as little as 72 hours! Pretty smooth process overall.

Use Your Funds Wisely

Once the capital hits your bank account, put it to good use growing your biz! Here are some smart ways you could invest the funds:

- Hire critical staff – Bring on extra help to lift business operations

- Renovate spaces – Upgrade your physical location

- Purchase new tech – Computer upgrades to work faster/smarter

- Boost marketing – Run ads to bring in new leads and sales

- Pay quarterly taxes – Avoid penalties by paying on time

The key is using the capital for high-ROI expenses that will take your revenue to the next level.

Why Choose Fora Financial?

Still wondering if Fora Financial is the right financing partner for your small business? Here are three great reasons to go with them:

- Fast funding – Get approved in 24 hrs and funded in 72 hrs

- Low fees – No application fees or prepayment penalties

- Easy process – Quick online application and account setup

For the fastest and most accessible small business loan process around, Fora Financial is a top choice!

Hope this beginner’s guide gave you all the key details on getting started! Feel free to reach out with any other questions.

Good luck! Now go grab the financing you need to grow. 😊